carried interest tax concession

The legislative council brief accompanying the Bill specifies that carried interest derived from a hedging transaction may only be eligible for the Tax Concession if the hedging transaction forms part and parcel of the private equity transaction and the profits on the hedging transaction are embedded in the profits or loss on such transaction for the calculation of. Eligible carried interest recipients.

Us Tax Accountant In Singapore Us Expat Tax Singapore

Specifically the carried interest must arise from a tax-exempted qualifying transaction in the shares stocks.

. Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax. The long-awaited Bill seeks to promote the development of private equity PE funds in Hong Kong by ushering in a 0 profits tax rate on eligible carried interest and excluding 100 of eligible carried interest from. The Bill proposes a tax regime offering tax incentives for eligible carried interest of qualifying persons and qualifying employees.

The proposal states that the tax concession only applies to carried interest distributed by PE transactions only. In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021. In line with our policy objective to promote the development of PE funds in Hong Kong concessionary tax treatment would be ring-fenced to eligible carried interest arising from qualifying transactions.

The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to the Inland Revenue Ordinance IRO. For tax concessions under the tax concession regime for carried interest. For qualifying carried interest recipients subject to profits tax ie the fund management entities under Part V of the Securities and Futures Ordinance carried interest payments would first need be netted off against outgoings and expenses and depreciation to arrive at the net carried interest eligible for the concession.

That is where an entity that is recipient of the carried interest return pays part of the return to its employees that payment will be concessionally taxed. Received a preferred return at an annual rate of 6 compound interest that would also be considered carried interest. The Regime operates to provide tax concession at both the salaries tax and profits tax levels.

Subject to the passage of the Bill by the Legislative Council the. On 7 May 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 the Amendment Ordinance was enacted into law. On 29 January 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill was gazetted to amend the Inland Revenue Ordinance and introduce a concessionary tax treatment on eligible carried interest received by or accrued to qualifying recipients on or after 1 April 2020.

Taxation of Carried Interest The current tax treatment of carried interest is the result of the intersection of several parts of the. On 7 May 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance came into operation introducing the much-anticipated Carried Interest Tax Concession Regime the Regime. Applying retrospectively to tax years commencing on or after 1 April 2020 the Amendment Ordinance has essentially transformed Hong Kong into one of the most tax efficient jurisdictions for fund.

Overview of tax concession regime for qualified carried interest The Bill confirms that eligible carried interest distributions are to be taxed at a 0 rate for qualifying persons who are subject to profits tax and for qualifying employees subject to salaries tax. 11 rows As part of a longstanding Government policy to attract private equity PE and investment fund. On January 4 2021 the Hong Kong Government announced that under its latest proposal on the carried interest tax concession it would set the tax rate at 0 and that an amendment bill to enact the latest proposal is expected to be introduced into the Legislative Council in late January 2021.

As proposed the concessionary tax rate will have retrospective. Tax Concessions for Carried Interest Bill 2021 the Bill for first reading in the Legislative Council on 3 February 2021. Furthermore the Proposal clarifies that 100 of eligible carried interest would also be excluded from the employment income for the calculation of the investment professionals salaries tax.

Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper. The tax concession for a carried interest also looks through to the employees. Carried interest tax concession - conditions Must be paid by a qualifying payer The carried interest must be paid by a certified investment fund ie.

The New Law applies to eligible carried interest received or accrued on or after 1 April 2020. Only carried interest distributed out of tax-exempted qualifying transactions in private equity investments ie shares stocks debentures loan stocks funds bonds or notes of or issued by a private company under Schedule 16C of the Inland Revenue Ordinance would be eligible for the tax concession. To qualify for the tax concession the fund must be validated by the HKMA.

The legislation sets a 0 rate for eligible carried interest for individuals and employees that pay profits tax and salaries tax in Hong Kong. Qualifying Transactions of Certified Investment Funds 10. The Hong Kong Government introduced the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill on 28 January 2021.

Carried interest has previously been treated as a. The tax concession regime for carried interest distributed by eligible private equity funds operating in Hong Kong alongside the enhancements to the profits tax exemption that was initially introduced in April 2019 offer additional strong incentive and an attractive tax framework for fund operators to establish and operate private equity funds in Hong Kong while. Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime offering tax incentives for eligible carried interest of qualifying persons and qualifying employees.

Generally fixed as a percentage of assets the carried interest is variable because it is generally a share of fund profits once specified investment returns have been met ie subject to a hurdle rate.

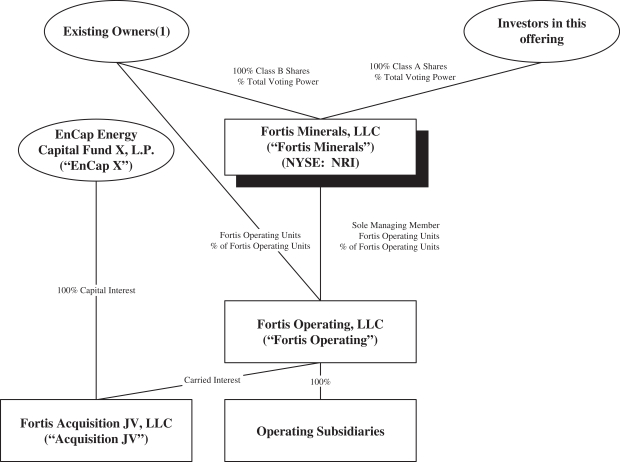

Hong Kong Private Equity Game Changer Slaughter And May Insights

Asc 740 Q1 2022 Provision Considerations

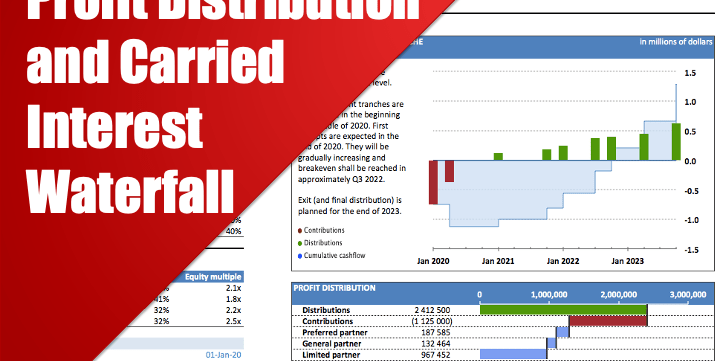

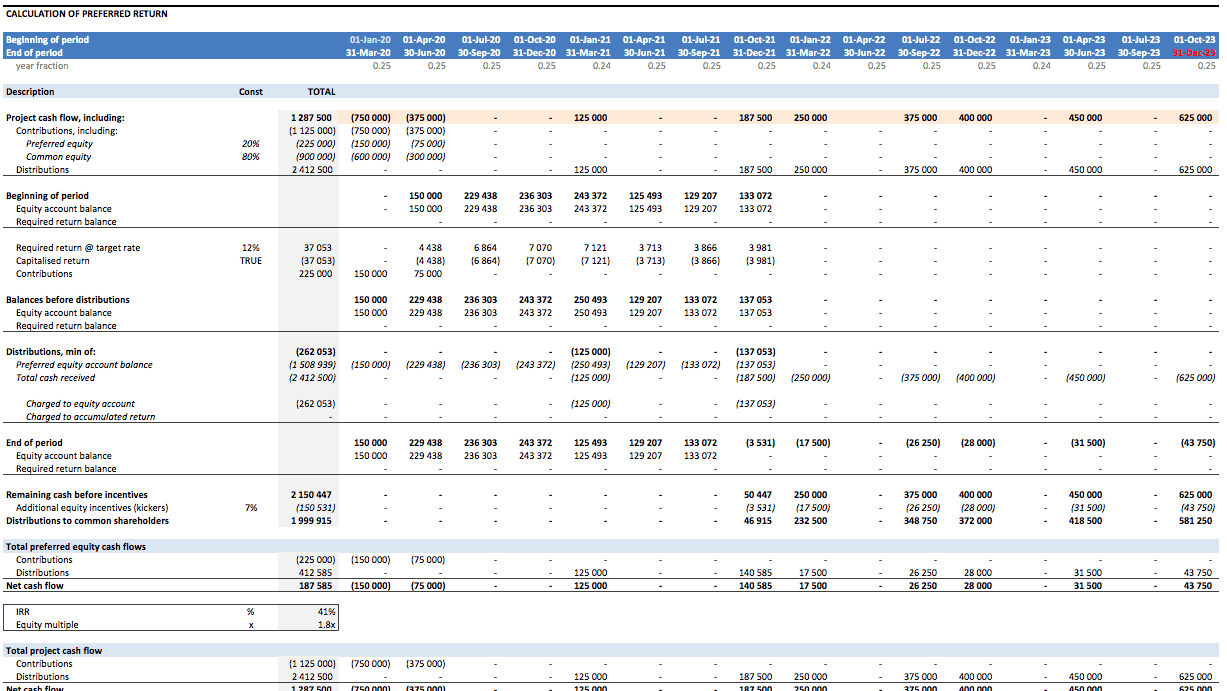

Waterfall Model Template In Excel Efinancialmodels

Waterfall Model Template In Excel Efinancialmodels

Waterfall Model Template In Excel Efinancialmodels

Waterfall Model Template In Excel Efinancialmodels

Waterfall Model Template In Excel Efinancialmodels

Waterfall Model Template In Excel Efinancialmodels

What Is Carried Interest Carried Interest Is The Share Of Profits That Go To The General Partners Of A Privat Finance Investing Finance Accounting And Finance

What Is Carried Interest Carried Interest Is The Share Of Profits That Go To The General Partners Of A Privat Finance Investing Finance Accounting And Finance